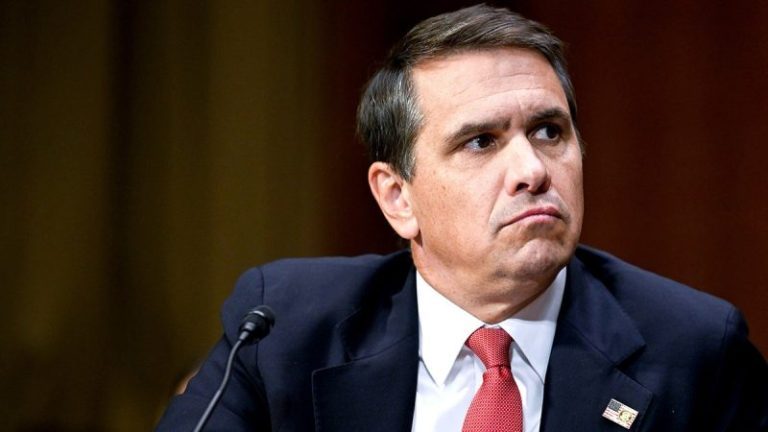

In the annals of ‘smoking gun’ documents, the recently revealed handwritten notes by James Comey rank right up there with the infamous tapes that imploded Richard Nixon’s presidency.

Unfortunately, the ex-FBI potentate is ‘Nixonian’ in a myriad of ways — needy, narcissistic, vindictive and manipulative. They both professed honesty but treated truth with utter contempt. Nixon gave us Watergate while Comey bequeathed the Russia Hoax. Each was forced from office mired in disgrace.

Alas, there’s one more eerie resemblance. Just as Nixon tried to sabotage his infamous Oval Office recordings, Comey’s combustible notes were consigned to an incinerator.

Stuffed in one of five ‘burn bags’ that were secretly squirreled away in a locked high security room at the FBI, his self-incriminating scribbles were supposed to go up in smoke. For reasons unknown or undisclosed, they did not.

In one damning note, Comey confirms what some of us have known and argued all along — he knew almost at the outset of the Russia collusion narrative that it was an odious fiction conjured up by former Secretary of State Hillary Clinton’s campaign and personally approved by her on July 26, 2016.

Clinton’s objective, according to Special Counsel John Durham’s 2023 report, was ‘to vilify Donald Trump by stirring up a scandal claiming interference by the Russian security services,’ thereby tipping the upcoming presidential election in her favor.

When later questioned by Congress about his knowledge of the epic deceit, Comey claimed an acute case of amnesia. He feigned no recollection whatsoever of Clinton’s opprobrious plot to smear Trump.

However, Comey’s missive to himself puts a conspicuous lie to that testimony. It reads, ‘HRC plan to tie Trump.’ It is not something that anyone would ever forget.

While it is difficult to discern, the information appears attributable to ‘JB,’ which is almost certainly then-CIA Director John Brennan. This comports with Brennan’s own declassified handwritten notes that intelligence communications had uncovered Clinton’s political chicanery.

At an urgent White House meeting, Brennan had disclosed the shocking information to President Barack Obama, Vice President Joe Biden and Comey. Instead of divulging the truth to the American public, they all remained mum and watched idly — perhaps happily — as the hoax gradually morphed into full-blown faux scandal that nearly toppled Trump’s presidency.

Comey’s notes verify his awareness of the ‘Clinton Plan,’ as it was dubbed. They are written on an FBI notepad marked ‘Director’ and dated Sept. 26, 2016, which coincides in time with a meeting of high-ranking U.S. national security officials that included Brennan and James Clapper, director of National Intelligence (DNI).

Instead of pursuing Clinton for a criminal scheme to defraud the government in a presidential election, as U.S. intelligence officials strongly recommended to the FBI in a ‘Referral Memo’ on Sept. 7, 2016, the unscrupulous Comey did just the opposite. He appropriated Clinton’s fabrication to target her opponent.

When later questioned by Congress about his knowledge of the epic deceit, Comey claimed an acute case of amnesia. He feigned no recollection whatsoever of Clinton’s opprobrious plot to smear Trump.

Simultaneously, Comey concealed the ‘Clinton Plan’ because it was highly exculpatory. If it became known or if Congress was informed, it would unmask Hillary’s treachery and exonerate Trump of any wrongdoing in the collusion fable.

Comey was not about to let that happen. He had already launched without predicate his dilating investigation of Trump and was deeply invested in protecting Hillary.

You will recall that, on July 5, 2016, Comey stood before television cameras and, absent any authority, inexplicably cleared the presumptive Democratic nominee of the various crimes that she had clearly committed in her notorious email fiasco over the deliberate and reckless mishandling of classified records. But that’s not all.

Comey also scuttled the bureau’s investigation into suspected criminal activity surrounding the Clinton Foundation and the millions of dollars funneled into it from Russian and other foreign sources. Substantial evidence developed by U.S. attorneys was thereafter buried on his orders. You can read about it in the Durham Report, pages 78-81.

July 5 was also a pivotal day for another reason, as I explained in my 2018 book, ‘The Russia Hoax.’

At the very moment that Comey was absolving Clinton, his FBI was furtively meeting with the author of the phony anti-Trump ‘dossier’ funded by Hillary and Democrats. Although the FBI swiftly debunked Christopher Steele’s scurrilous document, Comey was undeterred. He exploited it as a pretext in a malicious attempt to frame Trump for unidentified crimes he never committed.

Comey’s motivation was obvious. His newly unearthed emails show that he expected Clinton would win the election. He even bragged that he would soon be working for a president-elect Clinton who would be ‘very grateful.’ His gamble fueled corrupt acts.

Comey never imagined that Trump would prevail. So, he politicized his power and weaponized the FBI to meddle in the presidential contest for the benefit of Hillary. When his illicit scheme failed and Trump was elected, Comey doubled down on the collusion hoax in an attempt to destroy Trump and drive him from office.

This is what abuse of power looks like. Facts were invented or exaggerated. Laws were perverted and ignored. The law enforcers became the lawbreakers. They falsely accused Trump while shielding the real culprit, Clinton.

Comey’s ‘smoking gun’ notes only came to light because he recently filed several motions to dismiss his federal indictment in Virginia for false statements and obstruction of Congress. Among other things, he ironically asserts vindictive prosecution by Trump and separately contends that interim U.S. Attorney Lindsey Halligan’s appointment was improper. The outcome of those matters is pending.

Prosecutors responded to the first motion by sharing a trove of documents — many of them classified — discovered in the five ‘burn bags.’

They were destined for a smoky grave just days before Trump assumed office again on Jan. 20, 2025, in what can only be described as a brazen attempt to obstruct justice and commit the crime of willful destruction of documents under 18 U.S.C. 2071. Who was behind it, we don’t yet know.

Comey’s motivation was obvious. His newly unearthed emails show that he expected Clinton would win the election.

In addition to the notes that Comey penned, other uncovered records cited in the court filing further substantiate the government’s charges that he lied to Congress when he denied authorizing anonymous leaks to the press in violation of FBI guidelines. He was covertly manipulating media reporting through a conduit.

After one successful leak, Comey sent a message to his collaborator stating, ‘Well done my friend. Who knew this would. E [sic] so uh fun.’ (Who knew this would be so fun.) Deploying a Gmail account, he hid his intrigues under the alias ‘Reinhold Niebuhr,’ a deceased ethicist. There was nothing moral about what Comey was doing. It was sleazy.

But that’s not all. Among the ‘burn bag’ contents were materials that reveal the appalling breadth of the lawfare campaign waged first by the Obama administration and, later, the Biden administration against Trump and many others. Some of the documents shed vital light on the January 6 breach of the Capitol, the 2020 election dispute and the FBI’s dubious raid on Mar-a-Lago.

All of that was leveraged by Special Counsel Jack Smith to ignite the double indictments against Trump that were eventually tossed. The evidence is compelling that both prosecutions were politically motivated to stop him from retaking the White House.

The genesis of those two cases arose from a secret FBI investigation code named ‘Arctic Frost,’ approved by Attorney General Merrick Garland and then-FBI Director Christopher Wray in April 2022. In due time, Smith surreptitiously obtained nearly 200 subpoenas to capture personal telephone communications of more than 400 Republicans. Anyone in Trump’s orbit was targeted, including eight U.S. senators and even media organizations.

It is no accident that the stunning discovery of the ‘burn bags’ dovetails with a newly impaneled grand jury investigation in South Florida that encompasses the whole gamut of corrupt acts aimed at Trump — from the ‘Crossfire Hurricane’ debacle to the errant ‘Arctic Frost’ probe. The former evolved into the latter that led to the misbegotten Smith prosecutions. Altogether, they impacted three successive presidential elections. More than two dozen subpoenas are reportedly being issued for the grand jury to consider.

Evidence of an expansive and ongoing conspiracy to torment Trump will likely be examined in the context of two federal anti-corruption statutes that criminalize abuses of power, 18 U.S.C. 241 and 242. These civil rights laws make it a felony to willfully deprive people of their constitutional rights under color of law or pretense of legal authority.

Additional documents uncovered and declassified by current DNI Tulsi Gabbard and CIA Director John Ratcliffe have contributed to the mounting evidence of manufactured intelligence and criminal wrongdoing that the grand jury will inevitably evaluate.

As Comey works hard to avoid the Virginia trial that he insists he wants, his nefarious machinations that instigated the long-running lawfare campaign will not escape the direct attention of the Florida grand jury. The same is true of other government actors who mangled facts and contorted the law to persecute Trump in an unbridled crusade that ran roughshod over our legal system for nearly a decade.

During that time, the rule of law came under sustained attack by high government officials like Comey and so many others who abused their positions of power to subvert our framework of justice and undermine the democratic process.

The enemy is within. Trump was their target … and their victim. And so were the American people. They were harmed and forced to endure a divisive national trauma that should never have been. The wounds are still with us. And so, a reckoning awaits.

Yet, just as Nixon evaded prosecution by courtesy of a pardon, will Comey somehow elude accountability?

This post appeared first on FOX NEWS