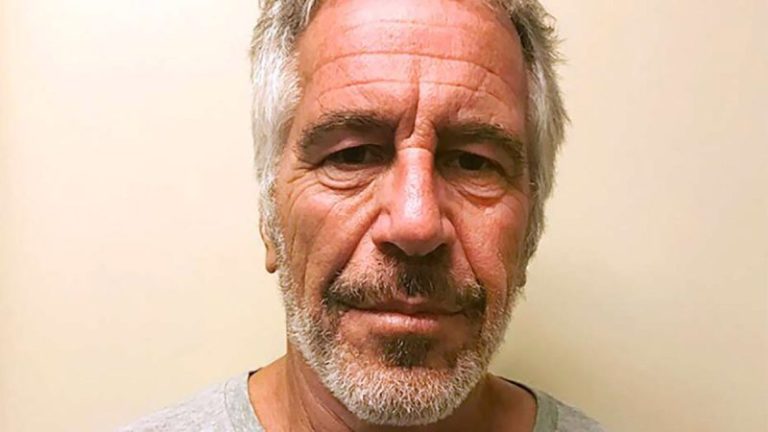

The U.S. Department of Justice (DOJ) said Sunday it restored a photo featuring President Donald Trump to its latest release of Jeffrey Epstein–related documents after a review determined the image did not depict any Epstein victims.

In a post on X, the DOJ said the photo was initially taken down ‘out of an abundance of caution’ after the Southern District of New York flagged it for additional review to protect potential victims.

Following a review, officials concluded no Epstein victims were shown in the photograph, and it was reposted without ‘alteration or redaction,’ according to the DOJ.

‘The Southern District of New York flagged an image of President Trump for potential further action to protect victims,’ the DOJ wrote. ‘Out of an abundance of caution, the Department of Justice temporarily removed the image for further review. After the review, it was determined there is no evidence that any Epstein victims are depicted in the photograph, and it has been reposted without any alteration or redaction.’

Earlier Sunday, Deputy Attorney General Todd Blanche said the removal of the photo had ‘nothing to do with President Trump’ and was instead driven by concerns for the women depicted, he said during an appearance on NBC’s ‘Meet the Press.’

The explanation came after reports that at least 16 files had disappeared from the DOJ’s Epstein-related public webpage less than a day after they were posted on Friday, without public notice or an initial explanation, The Associated Press reported.

The missing files included one that showed a series of photos displayed on a cabinet and inside a drawer. In the drawer, there was a photo of Donald Trump pictured alongside Melania Trump, Epstein and Ghislaine Maxwell, AP reported.

On Saturday, Democrats on the House Oversight Committee criticized the removal of the photo, writing, ‘We need transparency for the American public.’

‘This photo, file 468, from the Epstein files that includes Donald Trump has apparently now been removed from the DOJ release,’ Democrats on the House Oversight Committee posted on X. ‘[Attorney General Pam Bondi] is this true? What else is being covered up? We need transparency for the American public.’

The DOJ released the trove of files after The Epstein Files Transparency Act, signed by President Trump on Nov. 19, 2025, required AG Pam Bondi to release all unclassified records, communications and investigative materials related to Epstein within 30 days.

The agency posted thousands of pages on a government website Friday related to Epstein’s and Maxwell’s sex-trafficking cases. The files were released as the result of a deadline imposed by the Epstein Files Transparency Act.

Fox News Digital’s Lori Bashian contributed to this report.