The U.S. is preparing to expand the deployment of advanced missile systems in the northern Philippines, placing additional long-range strike capability within range of key Chinese military assets and reinforcing Washington’s effort to counter Beijing’s growing assertiveness across the Indo-Pacific.

U.S. and Philippine officials announced plans to increase deployments of ‘cutting-edge missile and unmanned systems’ to the treaty ally, as both governments condemned what they described as China’s ‘illegal, coercive, aggressive and deceptive activities’ in the South China Sea.

The move comes as confrontations between Chinese and Philippine vessels have intensified in disputed waters and as Beijing continues to pressure Taiwan, raising the stakes across the region’s most sensitive flashpoints.

It builds on the deployment of the U.S. Army’s Typhon missile system in northern Luzon, Philippines, a ground-based launcher capable of firing Tomahawk cruise missiles that can travel more than 1,000 miles.

Tomahawks can travel more than 1,000 miles — a range that, from northern Luzon, Philippines, places portions of southern China and major People’s Liberation Army (PLA) facilities within reach. The positioning also allows the U.S. and Philippine militaries to cover large swaths of the South China Sea and key maritime corridors connecting it to the broader Pacific.

The U.S. first deployed the Typhon system to Luzon, Philippines, in April 2024. An anti-ship missile launcher known as the Navy Marine Expeditionary Ship Interdiction System was deployed in 2025 to Batan Island in the northernmost Philippine province of Batanes.

That island faces the Bashi Channel, a strategic waterway just south of Taiwan that serves as a critical transit route for commercial shipping and military vessels moving between the South China Sea and the Western Pacific. Control of that channel would be vital in any potential Taiwan contingency.

Beijing has urged Manila to withdraw the U.S. systems from its territory, but officials under President Ferdinand Marcos Jr. have rejected those demands.

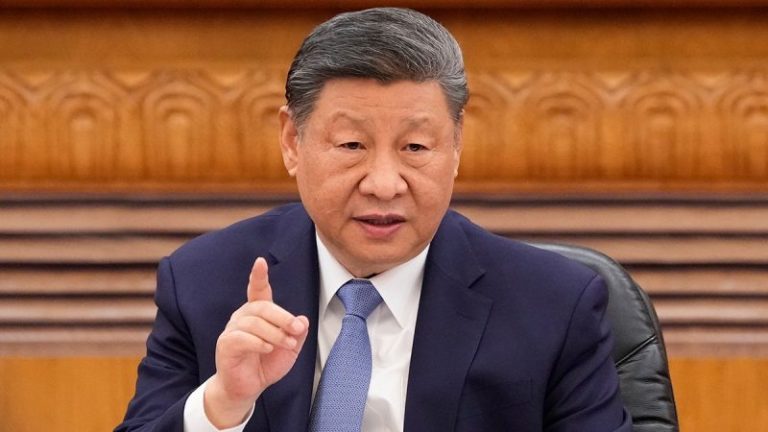

‘China has consistently stated its firm opposition to the United States’ deployment of advanced weapons systems in the Philippines. The introduction of strategic and offensive weapons that heighten regional tensions, fuel geopolitical confrontation, and risk triggering an arms race is extremely dangerous. Such actions are irresponsible to the people of the Philippines, to Southeast Asian nations, and to regional security as a whole,’ Chinese embassy spokesperson Liu Pengyu told Fox News Digital. ‘The United States is not a party to disputes in the South China Sea and has no standing to intervene in maritime issues between China and the Philippines.’

‘The Taiwan question lies at the very heart of China’s core interests. China’s determination to defend its national sovereignty, security, and territorial integrity is unwavering. Any provocation that crosses red lines on Taiwan will be met with resolute countermeasures, and any attempt to obstruct China’s reunification is doomed to fail,’ Liu continued.

Neither side detailed how many additional systems would be sent or whether the deployments would be permanent, but Philippine Ambassador to Washington Jose Manuel Romualdez said U.S. and Filipino defense officials discussed deploying upgraded missile launchers that Manila may eventually seek to purchase.

‘It’s a kind of system that’s really very sophisticated and will be deployed here in the hope that, down the road, we will be able to get our own,’ Romualdez told The Associated Press.

Romualdez stressed that the deployments are intended as a deterrent.

‘It’s purely for deterrence,’ he said. ‘Every time the Chinese show any kind of aggression, it only strengthens our resolve to have these types.’

China repeatedly has objected to the missile deployments, warning they threaten regional stability and accusing Washington of trying to contain its rise.

In a joint statement following annual bilateral talks in Manila, the U.S. and the Philippines underscored their support for freedom of navigation and unimpeded commerce in the South China Sea — a vital global trade artery through which trillions of dollars in goods pass each year.

‘Both sides condemned China’s illegal, coercive, aggressive and deceptive activities in the South China Sea, recognizing their adverse effects on regional peace and stability and the economies of the Indo-Pacific and beyond,’ the statement said.

China claims virtually the entire South China Sea despite an international tribunal ruling in 2016 that invalidated many of its sweeping claims. In recent years, Chinese coast guard and maritime militia vessels have clashed repeatedly with Philippine ships near disputed shoals, including Second Thomas Shoal.

The expanded missile deployments also come as the Pentagon balances rising tensions in multiple theaters. In recent weeks, the USS Abraham Lincoln carrier strike group — which had been operating in the Indo-Pacific — was redirected toward the Middle East as the U.S. moved to bolster its posture amid escalating tensions with Iran.

The deployments also reflect a broader U.S. effort to strengthen its military posture along the so-called ‘first island chain’ — a string of territories stretching from Japan through Taiwan and the Philippines that forms a natural barrier to Chinese naval expansion into the Pacific.

Washington has deepened defense cooperation with Manila under the Enhanced Defense Cooperation Agreement, expanding U.S. access to Philippine bases, including sites in northern Luzon close to Taiwan.

China in May released a national security white paper criticizing the deployment of an ‘intermediate-range missile system’ in the region — widely viewed as a reference to the U.S. Typhon launcher in the Philippines. The document accused unnamed countries of reviving a ‘Cold War mentality’ and forming military ‘small groups’ that aggravate regional tensions.

For U.S. planners, dispersing mobile, land-based missile systems across allied territory complicates Beijing’s military calculus. Instead of relying solely on ships and aircraft, the U.S. can field ground-based systems that are harder to track and capable of holding Chinese naval and air assets at risk.

For Beijing, however, such deployments reinforce its long-standing claim that the United States is encircling China militarily.

As tensions simmer in both the South China Sea and around Taiwan, the positioning of long-range U.S. missile systems on Philippine soil underscores how the strategic competition between Washington and Beijing is increasingly being defined by geography — and by which side can project credible deterrent power across it.