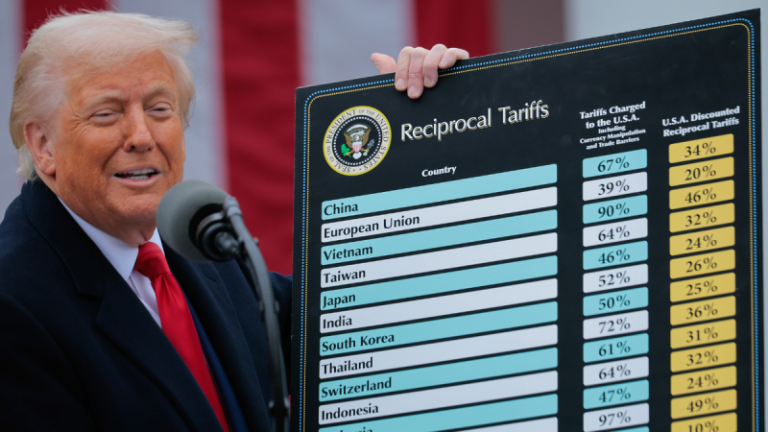

The Supreme Court is poised to rule soon on President Donald Trump’s use of an emergency wartime law to unilaterally impose sweeping tariffs on most U.S. countries — and which brought to the fore key questions over the ‘major questions doctrine,’ or the limiting principle by which courts can, in certain circumstances, move to curb the power of executive agencies.

During oral arguments over Trump’s tariffs in November, justices honed in on the so-called major questions doctrine — which allows courts to limit the power of executive agencies on actions with ‘vast economic and political significance’ — and how it squares with Trump’s use of the International Emergency Economic Powers Act to enact his sweeping global and reciprocal tariffs.

Plaintiffs told the court that Trump’s use of IEEPA to unilaterally impose his steep import duties violates the major questions doctrine, since IEEPA does not explicitly mention the word ‘tariffs.’ Rather, it authorizes the president to ‘regulate … importation’ during a declared national emergency — plaintiffs noted, arguing that it falls short of the standard needed to pass muster for MQD.

‘Congress does not (and could not) use such vague terminology to grant the executive virtually unconstrained taxing power of such staggering economic effect — literally trillions of dollars — shouldered by American businesses and consumers,’ they told the court in an earlier briefing.

Lawyers for the Trump administration countered that text of the IEEPA emergency law is the ‘practical equivalent’ of a tariff.

‘Tomorrow’s United States Supreme Court case is, literally, LIFE OR DEATH for our Country,’ Trump posted on Truth Social back in November.

‘With a Victory, we have tremendous, but fair, Financial and National Security. Without it, we are virtually defenseless against other Countries who have, for years, taken advantage of us,’ Trump continued.

‘Our Stock Market is consistently hitting Record Highs, and our Country has never been more respected than it is right now,’ he added. ‘A big part of this is the Economic Security created by Tariffs, and the Deals that we have negotiated because of them.’

While U.S. Solicitor General D. John Sauer acknowledged to the justices that IEEPA does not explicitly give an executive the power to regulate tariffs, he stressed in November that the power to tariff is ‘the natural common sense inference’ of IEEPA.

But whether the high court will back his argument remains to be seen.

That was the conclusion reached by the U.S. Court of International Trade last year. Judges on the three-judge panel voted unanimously to block Trump’s tariffs from taking force, ruling that, as commander in chief, Trump does not have ‘unbounded authority’ to impose tariffs under the emergency law.

‘The parties cite two doctrines—the nondelegation doctrine and the major questions doctrine—that the judiciary has developed to ensure that the branches do not impermissibly abdicate their respective constitutionally vested powers,’ the court said in its ruling.

The doctrine was also a focus in November, as justices pressed lawyers for the administration over IEEPA’s applicability to tariffs, or taxation powers, and asked the administration what guardrails, if any, exist to limit the whims of the executive branch, should they ultimately rule in Trump’s favor.

Though it’s not clear how much the court will rely on the MQD in its ruling, legal experts told Fox News Digital that they would expect it to potentially be cited by the Supreme Court if it blocks Trump’s tariff regime.

The high court agreed to take up the case on an expedited basis last fall, and a ruling is expected to be handed down within the coming days or weeks.

There’s very little precedent for major questions as a formal precedent cited by the courts, as noted by the University of Chicago College of Law in 2024.

The doctrine was cited formally by the Supreme Court for the first time ever in its 2022 ruling in West Virginia v. EPA, when the court’s majority cited the doctrine as its basis for invalidating the EPA’s emissions standards under the Clean Power Plan.

Prior to that, the doctrine existed as a more amorphous strand of statutory interpretation — a phenomenon that Justice Elena Kagan noted in her dissent in the same case.

‘The current Court is textualist only when being so suits it,’ Kagan said then. ‘When that method would frustrate broader goals, special canons like the ‘major questions doctrine’ magically appear as get-out-of-text-free cards.’

One factor that could play in Trump’s favor is the fact that the tariffs case is to some degree a foreign policy issue, which is an area where executives enjoy a higher level of deference from the court.

Still, if oral arguments were any indication, the justices seemed poised to block Trump’s use of IEEPA to continue his steep tariff plan.

Justices pressed Sauer as to why Trump invoked IEEPA to impose his sweeping tariffs, noting that doing so would be the first time a president used the law to set import taxes on trading partners.

They also seemed skeptical of the administration’s assertion that they did not need additional permission from Congress to use the law in such a sweeping manner, and pressed the administration’s lawyers on their contention that EEPA is only narrowly reviewable by the courts.

‘We agree that it’s a major power, but it’s in the context of a statute that is explicitly conferring major powers,’ Sauer said. ‘That the point of the statute is to confer major powers to address major questions — which are emergencies.’

This post appeared first on FOX NEWS