A Greek Odyssey

First of all, I apologize for any potential delays or inconsistencies this week. I’m currently writing this from a hotel room in Greece, surrounded by what I can only describe as the usual Greek chaos. Our flight back home was first delayed, then canceled, then rescheduled and delayed again. So instead of being back at my desk as planned, I’m getting back into the trenches from a small Greek town. But the markets wait for no one, so here we are!

Market Sector Shifts: Tech Takes the Lead

The changes in our top five aren’t massive, but they’re certainly worth noting. Technology has muscled its way back to the #1 spot, nudging Industrials down to second. Communication Services and Utilities are holding steady at positions #3 and #4 respectively. The most interesting move, imho, is Financials re-entering the top five at #5, up from #7 last week.

Real estate remains just outside at #6, while Consumer Staples has dropped out of the top five, landing at #7. Materials and Energy are still bringing up the rear at #8 and #9. In a bit of musical chairs, Consumer Discretionary and Health Care have swapped places — Discretionary now at #10 and Health Care down to #11.

- (2) Technology – (XLK)*

- (1) Industrials – (XLI)*

- (3) Communication Services – (XLC)

- (4) Utilities – (XLU)

- (7) Financials – (XLF)*

- (6) Real-Estate – (XLRE)

- (5) Consumer Staples – (XLP)*

- (8) Materials – (XLB)

- (9) Energy – (XLE)

- (11) Consumer Discretionary – (XLY)*

- (10) Healthcare – (XLV)*

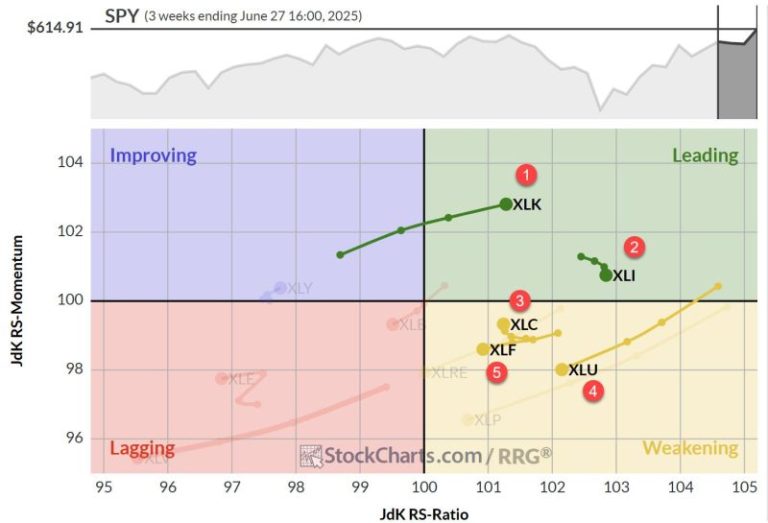

Weekly RRG

The weekly Relative Rotation Graph (RRG) paints a clear picture of Technology’s strength as it powers further into the leading quadrant. Industrials is still in the lead, but has started to lose some relative momentum — though it’s maintaining the highest RS-ratio reading. Communication Services is showing a clear upward rotation, while Financials and Utilities are inside the weakening quadrant with negative headings (but still above the 100 level, keeping them in the top five).

Daily RRG

- Technology and Communication Services flexing their muscles in the leading quadrant

- Industrials inside lagging, but turning back up

- Financials in improving on a positive heading

- Utilities rotating back down at a negative heading, close to crossing into lagging

The sector at risk here is clearly Utilities — at least for now.

Technology

The Technology sector chart is showing a very clear breakout above the resistance area around 240. It’s a decisive move, and that old resistance should now act as support. This breakout is mirrored in the relative strength line, which has continued its upward trajectory after breaking out of the falling channel.

Industrials

Industrials are also flexing their muscles, clearing overhead resistance with a nice breakout. The relative strength line, already out of its consolidation pattern, appears to be gaining momentum again. This is starting to drag the RS ratio line higher.

Communication Services

Communication Services is showing a clear upward break over the 105 resistance area. Just like Tech and Industrials, that old resistance is now expected to act as support. The price strength is finally reflected in the relative strength line, which has started to move up against the rising support line. This is causing the RS momentum line to pull up, almost crossing back over the 100 level, which should, in turn, push Communication Services back into the leading quadrant on the weekly RRG.

Utilities

Utilities, one of the defensive sectors in this cyclical power play, has remained static within its range. But in this market, standing still means losing relative strength. The utility sector is becoming increasingly at risk, with its relative strength chart returning to the trading range and heading towards the lower boundary. This is dragging the RRG lines lower.

Financials

Financials, our new entrant in the top five, is still grappling with the old rising support line and overhead resistance level. However, last week’s price action seems to have broken the sector out of a small consolidation pattern. If Financials can now take out the overhead resistance just above 52, it’ll be a powerful sign for this sector.

Portfolio Performance

From a portfolio performance perspective, we’re getting hurt by the strength of the Technology sector. It’s in the portfolio, but not enough to keep up with the S&P 500’s performance. We’re still underperforming by around 8%.

To turn this situation around, we need sustained moves higher by Technology, Communication Services, and potentially Financials. If Consumer Discretionary could join the party at some stage, that would be ideal — but it’s still far off at #10. For now, we’ll have to work with what we’ve got, especially from Tech and Communication Services, with potential boosts from Financials and Industrials. Utilities are likely to be a drag while they remain in the top five, given the current bullish market sentiment.

#StayAlert and have a great week. –Julius