Fortune Bay Corp. (TSXV: FOR) (FWB: 5QN) (OTCQB: FTBYF) (‘Fortune Bay’ or the ‘Company’) is pleased to announce that it has entered into a definitive option agreement (the ‘Agreement’), dated July 25, 2025, with Neu Horizon Uranium Limited ACN 653 749 145 (the ‘Optionee’), a private Australian arms-length party. Pursuant to the Agreement, the Optionee will be granted the option (the ‘Option’) to acquire an eighty percent interest in The Woods Uranium Projects (‘The Woods’ or the ‘Projects’) located on the northern margin of the Athabasca Basin, Saskatchewan (Figure 1).

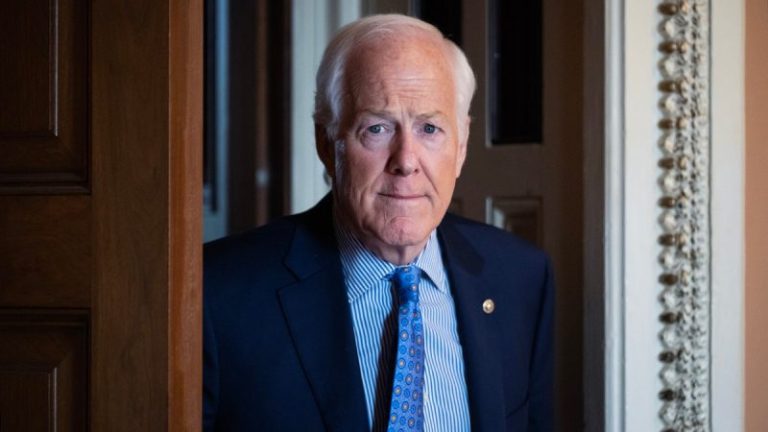

Figure 1: The Woods Uranium Projects – District-Scale Opportunity (CNW Group/Fortune Bay Corp.)

The Woods Highlights:

- District-scale opportunity, including five projects covering approximately 40,000 hectares.

- A dominant land position along the Grease River Shear Zone (‘GRSZ’) within 30 kilometres of the northern Athabasca Basin margin.

- The GRSZ is significantly underexplored relative to other major Athabasca Basin structures (less than 20 historical drill holes northeast of Fond du Lac, and only 3 historical drill holes on the Projects).

- Geological settings and structural features are prospective for; 1) unconformity-related basement-hosted uranium deposits, 2) magmatic intrusive uranium deposits and, 3) rare earth element (‘REE’) deposits.

- Abundant historical uranium and REE showings, and the highest lake sediment uranium anomalies in Saskatchewan.

Dale Verran, CEO of Fortune Bay, commented: ‘We are pleased to have executed a Definitive Option Agreement with Neu Horizon for the advancement of The Woods Uranium Projects. This partnership combines strong technical capabilities and capital markets expertise to accelerate exploration efforts on these high-potential projects at a time of strengthening uranium market fundamentals. The transaction reflects our disciplined approach to capital allocation—prioritizing spend on our core gold assets at Goldfields and Poma Rosa—while unlocking blue-sky potential from earlier-stage projects through partnerships that preserve upside for our shareholders.’

Martin Holland, Executive Chairman of Neu Horizon Uranium, added: ‘We’re pleased to have successfully closed the earn-in agreement with Fortune Bay and to partner with an experienced in-country team, complementing Neu’s strong technical expertise. With this foundation in place, we’re eager to hit the ground running and carry out substantial work to position the project for drilling ahead of our planned ASX IPO in Q1 2026.’

Key Terms

Consistent with the Letter of Intent (the ‘LOI’) signed in May, 2025, the Option is exercisable by the Optionee completing staged cash payments and share issuances, and incurring the following exploration expenditures on the Project:

|

Cash

|

Consideration

Shares

|

Exploration

Expenditures

|

Interest Earned

|

|

Signing of Definitive Agreement

|

A$50,000

|

A$50,000

|

Nil

|

80 %

|

|

31 December 2025

|

Nil

|

A$200,000

|

A$700,000

|

|

31 December 2026

|

Nil

|

A$500,000

|

A$2,300,000

|

|

Total

|

A$50,000

|

A$750,000

|

A$3,000,000

|

|

The Company will act as the operator during the Option period and will be entitled to charge a management fee of 10% of expenditures incurred on the Projects. A participating Joint Venture (‘JV’) will be formed at the end of the Option period, consistent with customary JV Terms. The JV will allow for dilution and should the Company’s interest fall below 10% the Company will be granted a 2% net smelter returns (‘NSR’) royalty. One-half (1%) of the NSR may be purchased at any time prior to commercial production for a cash payment of A$5 million, subject to Consumer Price Index increase.

Further Projects details are provided in the Company’s News Release dated May 29, 2025.

Qualified Person

The technical and scientific information in this news release has been reviewed and approved by Gareth Garlick, P.Geo., Technical Director of the Company, who is a Qualified Person as defined by NI 43-101. Mr. Garlick is an employee of Fortune Bay and is not independent of the Company under NI 43-101.

Technical Disclosure on Historical Results

The historical uranium and REE occurrences referenced in the ‘Woods Highlights’ section derive from the Saskatchewan Mineral Deposits Index. The lake sediment uranium anomalism referred to in the same section refers to historical results derived from the Saskatchewan Mineral Assessment Database file number 74O09-0004, in comparison with the open-source regional Saskatchewan lake sediment geochemistry database available on the Government of Saskatchewan Mining and Petroleum GeoAtlas. Historical results are not verified and there is a risk that any future confirmation work and exploration may produce results that substantially differ from these. The Company considers these unverified historical results relevant to assess the mineralization and economic potential of the property.

About Fortune Bay

Fortune Bay Corp. (TSXV:FOR, FWB:5QN, OTCQB:FTBYF) is an exploration and development company with 100% ownership in two advanced gold projects in Canada, Saskatchewan (Goldfields Project) and Mexico, Chiapas (Poma Rosa Project), both with exploration and development potential. The Company is also advancing seven uranium exploration projects on the northern rim of the Athabasca Basin, Saskatchewan, which have high-grade potential. The Company has a goal of building a mid-tier exploration and development Company through the advancement of its existing projects and the strategic acquisition of new projects to create a pipeline of growth opportunities. The Company’s corporate strategy is driven by a Board and Management team with a proven track record of discovery, project development and value creation. Further information on Fortune Bay and its assets can be found on the Company’s website at www.fortunebaycorp.com or by contacting us as info@fortunebaycorp.com or by telephone at 902-334-1919.

About Neu Horizon

Neu Horizon is a public unlisted Australian company focused on discovering and developing Tier 1 uranium deposits in premier exploration jurisdictions. Through this exciting new partnership with Fortune Bay, the company has access to a dominant land package with over 100,000ha of prime exploration ground covering three projects in Sweden and five projects in Canada.

Sweden is Europe’s leading mining nation and also hosts the world’s largest low-grade uranium resource within the Alum-shale, where Neu Horizon has a significant landholding. The company aims to take advantage of the Swedish Government’s plans to lift the 2018 moratorium on uranium exploration and mining to delineate a significant European uranium deposit.

Canada’s Athabasca Basin is the world’s leading source of high-grade uranium. Access to this land package along the northern rim of the basin provides Neu Horizon direct access to this underexplored uranium exploration frontier.

These strategic projects align Neu Horizon with the global demand for clean, sustainable and low-carbon energy, by taking advantage of both countries’ rich uranium resources and supportive mining legislation.

On behalf of Fortune Bay Corp.

‘Dale Verran’

Chief Executive Officer

902-334-1919

Cautionary Statement Regarding Forward-Looking Information

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management’s current estimates, beliefs, intentions, and expectations. They are not guarantees of future performance. Words such as ‘expects’, ‘aims’, ‘anticipates’, ‘targets’, ‘goals’, ‘projects’, ‘intends’, ‘plans’, ‘believes’, ‘seeks’, ‘estimates’, ‘continues’, ‘may’, variations of such words, and similar expressions and references to future periods, are intended to identify such forward-looking statements.

Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward looking information in this news release includes, but is not limited to, the Company’s objectives, goals, intentions or future plans, statements, exploration results, potential mineralization, timing of the commencement of operations and estimates of market conditions. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to failure to identify targets or mineralization, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, inability to fulfill the duty to accommodate First Nations and other indigenous peoples, inability to reach access agreements with other Project communities, amendments to applicable mining laws, uncertainties relating to the availability and costs of financing or partnerships needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital and operating costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR+. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. For more information on Fortune Bay, readers should refer to Fortune Bay’s website at www.fortunebaycorp.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Source

This post appeared first on investingnews.com