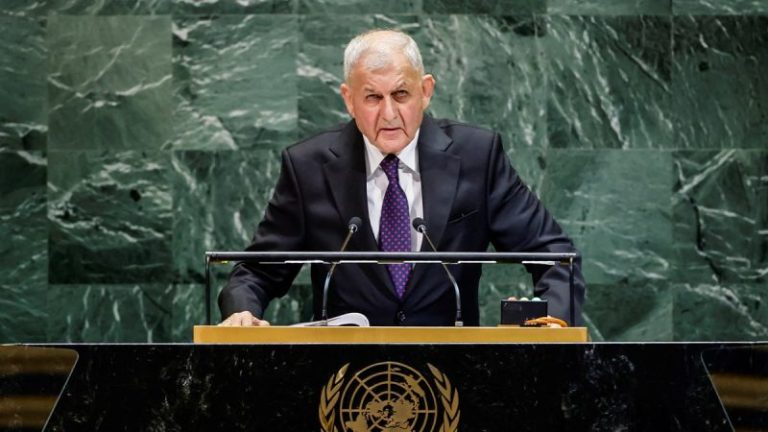

Iraq is entering ‘a new phase’ of stability and growth, President Abdullatif Jamal Rashid said in an interview, declaring the country ‘100% safe’ as U.S. troops prepare to draw down after more than two decades on the ground.

While praising the U.S. for helping to defeat ISIS, Rashid stressed that Iraq now intends to stand on its own — maintaining ties with both the United States and neighboring Iran.

‘Americans have helped us in defeating terrorism… and I think Iraq is 100% safe and secure,’ Rashid told Fox News Digital on the sidelines of the United Nations General Assembly. ‘It’s a new phase in Iraq, really concentrating on improving the infrastructure.’

Those who served in Iraq in the early 2000s — through the War on Terror and a civil war — may not recognize it as the same place, according to Rashid.

‘We have started development in every field of life, and there are good opportunities for number of American companies, American businessmen, to be our partner in improving the situation in Iraq.’

Under this ‘new phase,’ Rashid said he wants Iraq to be defined less by conflict and more by commerce.

‘Our relationship with the United States is a long relationship. We want to make a stronger relationship… on trade, on investment, on energy and water.’

The timing is significant. The U.S.-led coalition that toppled Saddam Hussein in 2003 and later fought ISIS was scheduled under an agreement last year to begin its final withdrawal this September. That exact timeline is unclear, and the Pentagon has disclosed few details.

The issue is sure to dominate next month’s parliamentary elections, where a swath of Iraqis want the U.S. to adhere to its agreement and leave.

‘This is a hot button political issue,’ said Behnam Taleblu, fellow at the Foundation for Defense of Democracies (FDD), ‘with a timetable that was technically — or at least allegedly — already supposed to have started by then, is going to be something that we should be keeping our eyes on.’

American commanders have warned that ISIS cells remain active in rural areas, while Iran-aligned militias have targeted U.S. and Iraqi government facilities with rockets and drones.

Some argue the counter-ISIS mission is not over, and U.S. troops should remain. Others say the U.S. footprint lacks a clear purpose at this point.

‘ISIS is a shell of its former self — the Caliphate collapsed in 2019 and its strikes on Europe have ended since then. The remaining threat can be handled by others, notably the Iraqi government, which is popular at home and capable of carrying the load, along with the Kurdish Peshmerga and other regional states,’ said Will Walldorf, a senior fellow at Defense Priorities.

‘Iran’s influence has waned with the near-total collapse of its regional proxies. Any threats the U.S. might face in the future can be handled from over the horizon.’

‘The deterrent effect of U.S. forces there, I think, could be significant,’ countered Taleblu.

Pressed on concerns, Rashid dismissed talk of Iraq being ‘overrun with Iranian proxies’ as exaggerated and said Baghdad is determined to prevent outside powers from dictating its politics.

‘We want to keep our independence, our decision-making in Iraq as the Iraqis, not to be influenced by outsiders,’ he said.

On reports of militia attacks, Rashid claimed ignorance but insisted such actions would not be tolerated.

‘I’m not really aware of any groups [carrying out attacks]. We will not allow it. And these are against the Iraqi security and Iraqi independence,’ he said.

Still, the perception of Iranian influence remains a flashpoint in Washington.

‘Iranian influence has already taken over Iraq,’ Rep. Joe Wilson, R-S.C., told Fox News Digital.

Tehran has close ties to Shiite parties that shape government coalitions in Baghdad, and it supports militias within the Popular Mobilization Forces that remain powerful players in the country’s security environment.

Iraq also relies on Iranian electricity and natural gas imports, while Iranian goods fill local markets, making Iraq one of Tehran’s most important trading partners despite international sanctions.

That reach, however, is not uncontested. Iraqi nationalist movements — including many Shiites — have resisted Tehran’s sway, and mass protests in recent years have condemned Iran’s role, sometimes targeting its consulates. Baghdad today remains a space of competing influence.

‘The Islamic Republic benefits from Iraq looking like Swiss cheese,’ said Taleblu, referring to Iranian pockets of influence across the country and its institutions.

‘Iran and Iraq are two neighbors,’ Rashid said, emphasizing that they had friendly relations. ‘We will not allow politicians from either [U.S. or Iraq] to be imposed on Iraqi people.’

Still others say Iran could take note of the Iraqi success story. In less than 20 years, the nation rose from decades of conflict and dictatorial leadership under Saddam Hussein to relative stability and democratic elections.

Rashid confirmed that Baghdad and the Kurdistan Regional Government have resolved their dispute over oil exports, paving the way for flows to resume after months of disruption. ‘It’s a big deal,’ said Rashid, who himself is Kurdish by background.

The Iraqi presidency is reserved for a Kurd under an informal power-sharing agreement, while the prime minister is Shi’a Arab and the speaker of the parliament is Sunni Arab.

Rashid also pointed to November’s parliamentary elections as proof of democratic stability.

‘We are going to have elections in two months’ time in November. That’s really an indication of how stable the country is… We want the process to be fully democratic,’ he said.

But the Popular Mobilization Forces (PMF) — a state-sanctioned umbrella of mostly Shiite militias, some with close ties to Tehran — are seen by critics as a parallel power structure undermining Iraq’s sovereignty.

Rashid, however, argued that integrating all armed groups under the constitution strengthens, rather than weakens, the state.

And on foreign policy, Rashid tried to position Iraq as a bridge.

He welcomed growing recognition of a Palestinian state, cautiously praised Donald Trump’s push for peace in Gaza, and reiterated that war — whether in the Middle East or in Ukraine — ‘doesn’t solve any problem. It makes the problem more complicated.’

This post appeared first on FOX NEWS