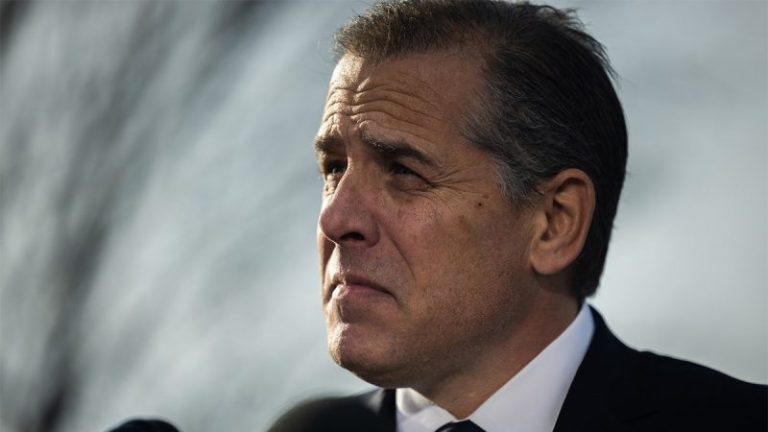

Colombia’s former defense minister Juan Carlos Pinzón warned that the once-close U.S.–Colombia alliance has ‘collapsed’ under President Gustavo Petro, accusing the leftist leader of aligning with Venezuela’s Nicolás Maduro and turning Colombia into a ‘narco-state.’

Pinzón, who is weighing a presidential run, told Fox News Digital he could ‘repair U.S.-Colombian relations in a week’ and urged international oversight of Colombia’s May elections amid what he called growing cartel influence and political corruption.

‘Petro has made himself an ally to [Venezuelan dictator Nicolás] Maduro’s regime, a narco-state, and a regime that is held mainly by the Cartel de los Soles,’ Pinzón said. ‘He has justified the existence of drug trafficking in Colombia … he has aligned himself with the idea of something that he calls ‘Total Peace,’ which implies that he’s providing benefits to drug traffickers and terrorist organizations and in general terms to organized crime.’

Relations between Washington and Bogotá — historically one of the closest U.S. security partnerships in Latin America — have deteriorated sharply under Petro, who has sought warmer ties with Caracas while distancing Colombia from the U.S. and Western allies.

During his tenure as defense minister from 2011 to 2015 under President Juan Manuel Santos, Pinzón oversaw some of Colombia’s most aggressive operations against the FARC and other armed groups, helping drive coca production and kidnappings to historic lows. As ambassador to Washington from 2015 to 2017, he helped secure Colombia’s designation as a major non-NATO ally, expanding intelligence sharing and military training programs with the U.S. — partnerships he now says have been ‘dismantled’ under Petro.

Under Petro’s ‘Total Peace’ policy, the Colombian government negotiates directly with armed criminal groups in an effort to end decades of internal conflict and integrate fighters into civilian life. Critics, including Pinzón, say the initiative has legitimized cartels and weakened the country’s security forces.

‘Homicide has gone up, terrorist actions have gone up, kidnappings have gone up, and the killing of police officers and military is increasing,’ he said. ‘All this is very bad for my country. And this is why I’m so committed to fight this, to confront this.’

Pinzón, who previously served as both defense minister and ambassador to Washington, is positioning himself as a pro-U.S. alternative ahead of Colombia’s 2026 presidential race. ‘I might announce a decision in the coming weeks,’ he said. ‘That’s something that I’m really considering.’

He also called for international election monitoring, warning that criminal networks could interfere in the vote. ‘If I were to ask something to the world today and to the international community — to the U.S., to the European Union, and even to countries in Asia — it’s that they make sure Colombian elections are not tainted by drug trafficking, illegal mining or terrorist hands,’ Pinzón said.

After a recent spat where Petro accused the U.S. of killing a Colombian fisherman in one of its seven Caribbean strikes targeting drug traffickers, Trump announced he would cut off all counter-narcotics aid to Colombia and hike tariffs on the nation.

Pinzón urged Washington not to punish ordinary Colombians for Petro’s policies.

‘It’s not regular Colombians who are doing this,’ he said. ‘Most of us completely disagree with what is going on under Petro. We don’t want to see tariffs that can affect jobs and businesses in Colombia.’

While he praised Trump’s stance against narco-trafficking and corruption, Pinzón said he hopes the U.S. will avoid cutting counternarcotics aid, which he described as vital to Colombia’s military and police forces on the front lines of the drug war. ‘Our military and police are the real fighters against drugs,’ he said. ‘They continue to sacrifice, they continue to confront terrorism and drug trafficking. If that support disappears, it’s the criminals who are going to benefit.’

Instead, Pinzón said Washington should focus on targeted financial sanctions—such as those imposed by the Treasury Department’s Office of Foreign Assets Control (OFAC)—to hit specific traffickers, corrupt officials and their enablers rather than imposing measures that ‘hurt regular Colombians.’ ‘We would prefer OFAC-style sanctions on the people committing crimes,’ he said, ‘not policies that punish those who oppose Petro’s agenda.’

Looking ahead to potential ties with Washington, Pinzón said he could quickly rebuild the partnership through renewed security and intelligence cooperation, technology exchange, and educational programs.

‘I will just come to the U.S., speak openly and clearly with President Trump and the U.S. leadership, and speak on the need of creating a security agreement again on intelligence, on air mobility, on technology, on combating drug trade, but also on critical minerals and education,’ he said. ‘We want more Colombians to come to U.S. schools and enhance their capabilities and come back to Colombia to create knowledge, wealth and prosperity. We’re going to be again the closest ally of the United States strategically in the region.’

If Colombia continues on its current course, Pinzón warned, it could destabilize the entire hemisphere. ‘Colombia is a stabilizer at the end,’ he said. ‘If Colombia fails, the whole region will fail.’

Asked if he would seek U.S. backing, Pinzón said he values bipartisan support. ‘Everybody knows that I will have a very good relationship with the United States, certainly with the current administration, with President Trump,’ he said.

Pinzón also accused Petro of ‘abandoning’ Colombian citizens during a diplomatic spat with Washington after refusing deportation flights from the U.S. because the migrants were shackled. He said he would cooperate on deportations and be open to broader agreements if asked.

‘When Afghanistan fell, we offered the U.S. even to take care of some of the Afghanis if necessary,’ Pinzón said. ‘When you have a strong relationship as the one we used to have between Colombia and the U.S., and we will have if I can get to the presidency, what we’re going to see is a lot of good coordination and a lot of good things for both the people of Colombia and the people of the United States.’

Fox News Digital reached out to the Colombian Embassy for comment but did not receive a response before publication.

This post appeared first on FOX NEWS