Direct Line Share Price Is Fluctuating. What Is the Forecast?

Direct Line Insurance Group PLC (DLG) stock traded in bearish territory on Tuesday and continued this trend on Wednesday. It is currently exchanging hands at 189.51 GBX, lower by 0.99% on the day. However, the Direct Line share price chart shows that it fluctuated between the highest point of 225.80 and the lowest point of 160.15 over the last six months.

During the 12-month period, the stock’s high remained the same (reached on March 12, 2024), but the lowest point was 147.05, reached on August 2, 2023.

Today’s Direct Line share price is somewhat average between the stock’s peaks and lows. DLG fell after hitting the 225.80 high but then came to another resistance level at 214.40 on May 31, 2024. Since then, DLG has been declining with small-range support and resistance levels.

Still, the current downfall is compounded by the London Stock Exchange’s bearish trend, it might continue for a short term before the market reverses its course.

Typically, stocks get caught up in the broader market’s direction, and during declining periods, most of them shed some of their gains. Only those with strong reports or optimistic news defy such fluctuations. But is DLG such a stock? And what do analysts forecast for it?

Thus far, Direct Line Group’s share price shows a tendency for decreasing, but will it change soon?

What Is DLG PLC?

Direct Line Insurance Group plc is a UK insurance company. It first appeared on the market in 2012 as The Royal Bank of Scotland Group’s insurance division’s divestment. At that time, the stock was available through an initial public offering (IPO).

This stock is exchanging hands at a discount price compared to its historical average. But it has shown weak operating performance lately. Besides, its recent turnaround program contains significant risk – if the company can’t execute it well, the stock value will lower further.

The company had to deal with some issues in the UK motor segment. The Direct Line share price news became more positive after Ageas started negotiations to buy its rival company. It managed to gain 23%, and this support bolstered the stock during the last several months.

Ageas first offered to purchase Direct Line several months ago. It offered approximately $3.9 billion, but the latter’s management rejected it, stating it was undervalued.

Despite Ageas’ attempts, Direct Line’s management refused further negotiations and thus, they didn’t reach any agreement. Considering the company’s current market value (£2.49B), the insurance company was offering it a fair deal, but it’s also true that DLG shares are trading at a discount now. The stock has the potential to become worth much more in the future.

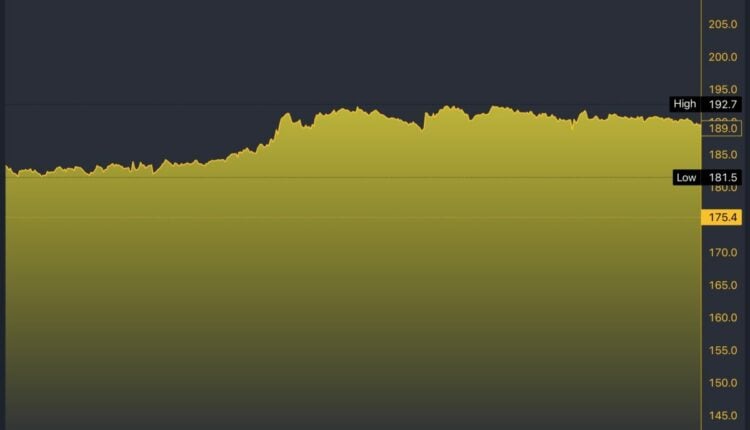

DLG/GBX 5-Day Chart

What Is the Direct Line Share Price Forecast?

According to Wall Street analysts’ 12-month price targets, the average share price target is currently 217.80p, with a consensus rating of a moderate buy.

The investors should consider that the UK motor segment influences this company, and the former has struggled during the last few years. The chip shortage issue during the COVID-19 pandemic caused an increase in used-car values. After that, repair costs soared due to growing inflation.

However, these issues are most likely temporary and when the sector strengthens, so will the DLG stock. In other insurance segments, it profited over the last two years. Not enough to overshadow the underperformance in the motor segment, though.

Meanwhile, some analysts forecast that the stock’s average price will be 228.05 in 2025, with its highest point reaching 350.00 and lowest point 195 in the next twelve months.

As you see, Direct Line shares have a strong potential to gain, but only if it manages to execute its plans flawlessly and the motor segment rebounds. You should follow the market news and trends to gain more insights about this stock’s further developments. Stay tuned for the hottest information!

The post Direct Line Share Price Is Fluctuating. What’s the Forecast? appeared first on FinanceBrokerage.